The liquidity provider you choose shapes execution from both sides: what’s visible to the trader and what happens behind the scenes. It directly affects performance under load and the stability of your pricing when the market moves.

Some brokers look for raw institutional access. Others need flexibility across onboarding, margin, technology, and support. What matters is clarity. You should know what kind of liquidity you’re working with, how it behaves under pressure, and whether the provider aligns with your risk and growth model.

We’ve written this article to clarify how to choose a liquidity provider without getting lost in marketing noise or shallow comparisons.

What is a liquidity provider?

A liquidity provider is the firm that supplies the buy and sell prices your trading platform displays to clients. When a client places an order, the liquidity provider is the one quoting the price and taking the other side of the trade, either by matching it internally or routing it into the broader market. Liquidity providers make it possible for trades to be executed instantly, without needing to wait for another retail client to take the opposite position. For brokers, the quality of that liquidity impacts pricing, execution speed, slippage, and overall platform performance.

Types of Liquidity Providers

There’s more than one way to access liquidity, and each option brings a different set of trade-offs in execution control, cost structure, operational complexity, and who you’re ultimately relying on when volume spikes.

Tier-1 providers are large institutions and banks. They sit close to the market and quote directly from their own books or aggregated feeds. If you have the infrastructure and volume to match, this route gives you reach and depth, but the bar for entry is high. Most Tier-1s require larger balances, stricter onboarding, and direct relationships that come with their own overhead.

Prime of Prime (PoP) providers sit in the middle. They give brokers access to institutional flow without the institutional barriers. That includes aggregated pricing, simpler account setup, and tools designed to help brokers manage risk, funding, and reporting. PoPs are often a better fit for firms that need quality execution without the burden of managing multiple Tier-1 relationships.

Then there are retail-focused LPs. These are often easier to work with in the short term, especially for brokers looking to move quickly. But you’ll want to evaluate how they source liquidity, what kind of clients they prioritize, and how transparent their setup really is.

How to Evaluate a Liquidity Provider

Spreads and Execution Cost

Don’t stop at what the provider claims and look at how pricing holds up in live trading conditions. Those “snapshots” can be taken during calm markets or at tiny trade sizes that don’t reflect real conditions. What matters is how prices hold up when the market is moving fast and orders are larger.

Ask for fill data over time. Look at the difference between quoted and executed prices. If possible, test with varying order sizes and execution speeds. For true insight, some brokers compare liquidity providers side-by-side using identical flow to track how execution costs behave under pressure. This tells you more than any headline number.

You also need total clarity on markups, commissions, and the provider’s last-look policy. Every detail affects your actual execution cost.

Liquidity Depth

A tight spread isn’t helpful if it only applies to the first 0.1 lot. If you’re pushing more volume, whether through prop trading, high-frequency flow, or active retail, you need to know how much can clear before prices slip.

Ask for historical depth data, specifically visualizations of the order book and fill statistics at different sizes and times. Review how pricing holds up as volume increases. If your strategy involves larger or faster trades, test whether the LP can keep up without causing slippage spikes or partial fills.

Be aware that some providers aggregate depth from multiple sources while others do not disclose how deep their book truly is. This lack of transparency can become a major operational risk. Your bottom line will feel the impact if depth breaks down when you need it most.

Integrations

Latency, stability, and compatibility directly impact what your traders see. It’s not just about where the quotes come from, it’s how fast they get there, and how cleanly they plug into your infrastructure.

Start with the basics: Which bridge providers (the software connecting your trading platform to liquidity) do they support? Where are their servers hosted, and how does that location impact latency for you and your clients? Do they offer failover routing or backup feeds? And how often do they report downtime or degradation?

An LP might have great pricing, but it can bottleneck your performance with poor routing or bad tech. If they can’t show a clear integration path with your current platform, keep looking.

Reputation and Transparency

A provider’s reputation is built from how they react when things behave unexpectedly. Do they reject trades without reason? Do they delay fills during volatile sessions? Are they upfront about where liquidity is coming from?

You want to work with partners who are consistent, not just competitive. That means clear documentation, visibility into how orders are processed, and openness around rejections, flow classifications, and risk controls.

If they avoid those questions or deflect with sales language, assume the relationship won’t hold under pressure.

Support and Responsiveness

When execution breaks, you need real help, and not a chatbot or a support alias that goes unanswered. Strong liquidity providers assign humans to your account. They follow up on anomalies, explain discrepancies, and keep an eye on performance.

Ask how escalations are handled. Ask whether you’ll have a direct line to someone who knows your flow. Ask if they monitor your activity or leave it to automation until something fails.

You’ll know the quality of support the first time something goes wrong. Better to understand the setup before that happens.

Brokeree’s Liquidity Bridge For Your Brokerage

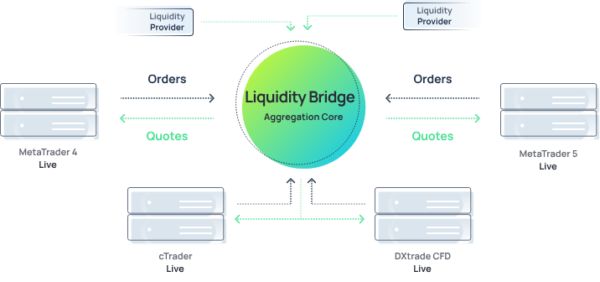

Brokeree’s Liquidity Bridge is a leading tool that aggregates pricing and depth from multiple liquidity sources. It currently supports access to providers like Advanced Markets, Ausprime, LMAX, Swissquote, IS Prime FX, FXCM Pro, Finalto, and others, letting brokers tap into diversified liquidity from institutions and prime aggregators.

Platform Connectivity

The Liquidity Bridge integrates with major trading platforms: MetaTrader 4, MetaTrader 5, cTrader, and DXtrade CFD. That ensures brokers can plug into deep liquidity across the platforms they already run.

Aggregated Pricing and DoM Visibility

What sets it apart is how it layers aggregated quotes into both market insights and decision control. The system generates consolidated price feeds and provides a Depth-of-Market view, giving brokers transparent visibility into how far liquidity stretches beyond top-of-book.

Execution Models and Risk Control

Brokers can choose how trades are handled: A-book (risk passed to an LP), B-book (risk internalized by the broker), or a hybrid. The bridge supports these models and adds operational safeguards like dynamic routing, depth limits, and backup feed support.

Related: A-Book vs B-Book: What’s the Difference?

Regulatory Reporting Integration

An interesting bonus: the Liquidity Bridge integrates with MAP FinTech, enabling brokers to simplify regulatory reporting while optimizing trading processes.

Closing Thoughts

There’s no universal checklist that guarantees the right liquidity partner. What works for one brokerage might create friction for another. That’s why it pays to look past the marketing and focus on how a provider actually fits into your business.

Spreads, depth, integration, transparency, none of these live in isolation. You need a partner that can hold up when the market moves, when your volume scales, or when a trader flags a fill and someone on your side needs answers fast.

The goal is stability you can build on, infrastructure that won’t break, and a relationship that doesn’t disappear after onboarding. The best LPs make themselves known in the quiet moments and the critical ones. If you’ve worked with both types, you already know the difference.

For a more reliable execution framework built on transparency and performance, request a personalized demo of Brokeree’s Liquidity Bridge today.

FAQs

How do I choose the right liquidity provider for my brokerage?

Choosing the right liquidity provider involves more than just comparing spreads. You should assess real execution quality (not just quotes), the depth of market support, server connectivity and latency, integration with your trading platform, and the provider’s responsiveness in live trading scenarios. Reputation and transparency also matter: ask how they handle rejected orders, outages, and fill audits. Finally, review commercial terms, such as margin requirements, funding thresholds, and kill switch access.

How does market depth affect trading execution?

Market depth reflects how much volume can be traded at or near the quoted price. A provider with strong depth can absorb larger trades without causing slippage. Without it, even small orders may trigger price movement, leading to partial fills or higher execution costs. Depth matters for all broker types, not just institutional desks, especially if you run prop accounts, high-frequency strategies, or larger-than-average positions.

Why is execution quality more important than just tight spreads?

Tight spreads look attractive but mean very little if the execution isn’t reliable. You might see a low quote, but if trades are routinely re-priced, partially filled, or delayed, your clients will feel the impact. Execution quality includes how often orders fill at the displayed price, how slippage is managed, and how the provider performs during volatile conditions. It’s the difference between a quote you can market and one your traders can trust.

What questions should I ask a liquidity provider before signing?

Before signing with a liquidity provider, ask:

- Can I see historical fill data?

- How do you handle order rejections or flow classification?

- Where are your servers located, and what’s your failover plan?

- What bridge and platform integrations do you support?

- Who do I contact during execution issues, and what’s the escalation path?

- What are the terms around margin, termination, and volume requirements?

The goal is to see how the provider behaves under stress.