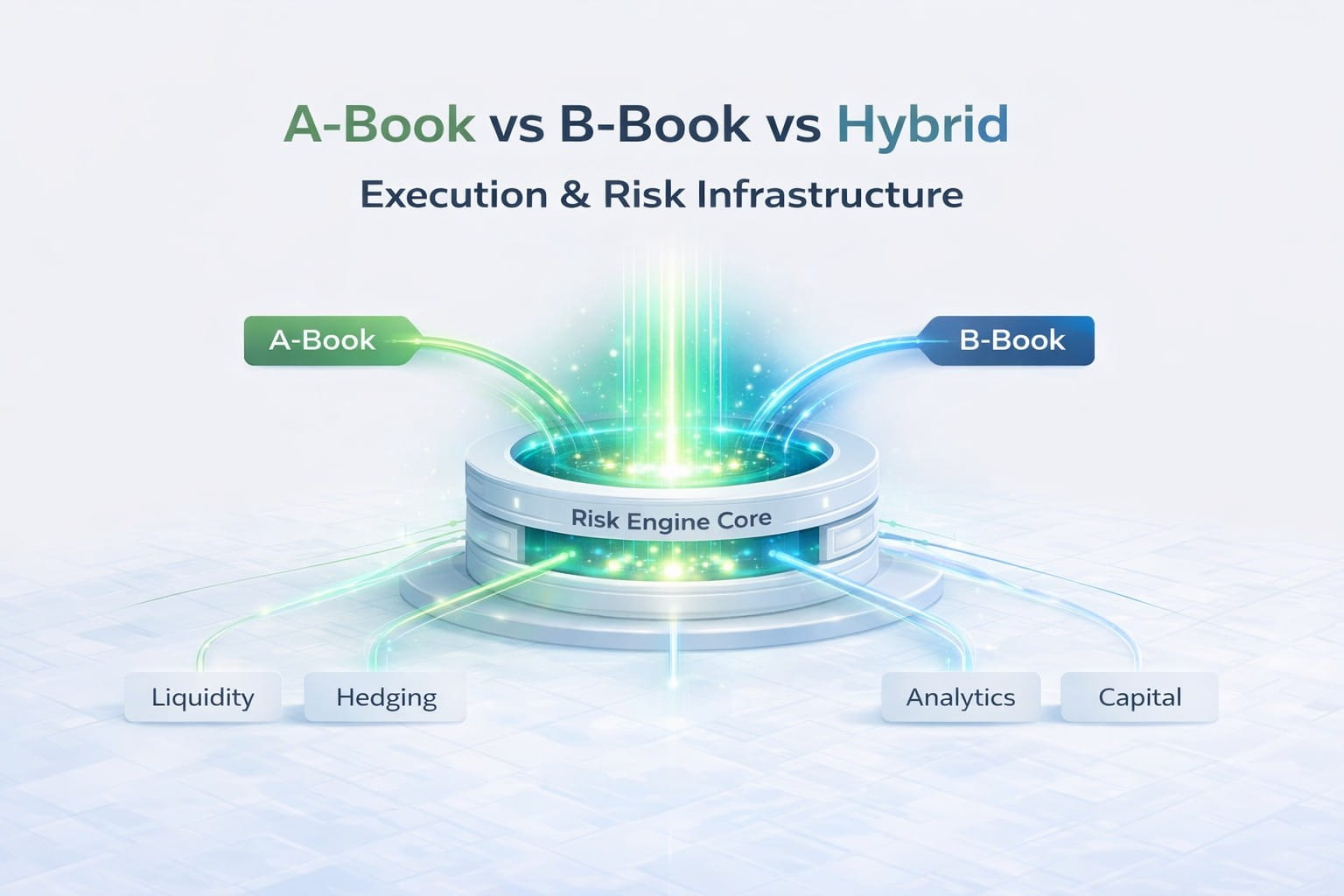

As a brokerage firm, choosing A-Book vs. B-Book models represents more than an operational decision; it defines your market position, revenue structure, and client relationships. This choice impacts your capital requirements, risk management strategies, and long-term growth potential in the forex and CFD markets.

Understanding A-Book Brokers

A-Book brokers operate on a straight-through processing model, where every client trade flows directly to the institutional market. Your platform becomes a sophisticated bridge between retail traders and major liquidity providers, offering true market access without dealer intervention.

When a client places a trade through your A-Book system, the execution process happens almost instantly. Let’s say a client wants to buy 5 lots of EUR/USD. Your system immediately scans prices from multiple liquidity providers, perhaps seeing one bank offering 1.0800/1.0802, while another showing 1.0801/1.0803. Within milliseconds, your platform executes at the best available price, adding your markup, and confirms the trade to both parties.

The revenue model in A-Book operations is transparent and volume-based. Most A-Book brokers earn through a combination of spread markup and per-lot commissions. For instance, if you add a 0.5 pip markup to the institutional spread and charge $5 per lot traded, a client trading $100 million daily generates roughly $5,500 in revenue – $500 from spread markup and $5,000 from commissions.

Running an A-Book operation demands substantial capital, which covers margin requirements with liquidity providers, regulatory capital, plus reserves for daily operations and technology infrastructure.

Understanding B-Book Brokers

B-Book brokers take a fundamentally different approach by creating an internal market. Instead of passing trades to liquidity providers, you become the market maker, taking the opposite side of client positions.

Consider a typical trading day at a B-Book desk. Client A opens a one-lot buy position in EUR/USD at 1.0800. Minutes later, Client B wants to sell 0.7 lots at 1.0801. Your system automatically matches part of these trades internally, leaving you with a net long exposure of 0.3 lots.

Revenue generation in the B-Book model comes from multiple streams. Unlike A-Book’s straightforward commission structure, you profit directly from client trading losses. When a client buys EUR/USD at 1.0800 and sells at 1.0790, that 10-pip loss becomes your gain. You also earn from wider spreads; while institutional EUR/USD spreads might be 0.2 pips, you can offer fixed spreads of 1.5 pips, creating consistent income regardless of market conditions.

The capital requirements for B-Book operations start lower than A-Book. This covers your regulatory obligations, provides a risk management buffer, and funds your technology infrastructure. However, you’ll need sophisticated risk management systems to monitor and manage client positions effectively.

A-Book vs. B-Book: Overview

| Aspect | A-Book | B-Book |

| Business Model | Pass trades to market | Market maker |

| Revenue Source | Commissions & markup | Client losses & spreads |

| Risk Profile | No market risk | Full market exposure |

| Technology Needs | Price aggregation, fast execution | Risk management, price creation |

| Target Clients | Professional traders, high volume | Retail traders, smaller volumes |

| Spread Type | Variable, market-based | Fixed, wider spreads |

| Execution Speed | Depends on liquidity providers | Internal, typically faster |

| Hedging Need | Automatic via STP | Manual or algorithmic |

| Profit Stability | More predictable, volume-based | Variable, depends on client performance |

Choosing Your Model

Your choice between A-Book vs. B-Book depends on key business factors. Let’s break down when each model works best.

Choose A-Book when:

- You have sufficient capital, giving you enough margin to work with top-tier liquidity providers and maintain healthy operational buffers. Without this capital base, you’ll struggle to maintain relationships with prime brokers and manage daily margin requirements.

- Your clients trade high volumes. Professional traders placing 5+ lot trades need instant execution and tight spreads. The commission-based revenue model works well here; even a $2 per lot commission on 1,000 lots daily generates $2,000 in reliable revenue.

- You focus on institutional clients. These clients demand market execution and often check prices against multiple venues. They need to see their orders hitting the market without dealer intervention.

- Your technology can handle high throughput. If you can process thousands of price updates per second and execute trades with sub-10 millisecond latency, you’re ready for A-Book operations.

Choose B-Book when:

- You start with less capital. This lower barrier to entry lets you build your business while managing risk carefully. You can expand to A-Book later as your capital grows.

- Your client base is mainly retail. Traders placing 0.1-1 lot orders don’t need institutional-grade execution. They prefer fixed spreads and instant execution, which B-Book models excel at providing.

- You have strong risk management expertise. One major market move can wipe out months of profit if positions aren’t managed well.

- You want pricing flexibility. B-Book lets you set spreads and pricing to match your risk appetite and market conditions. During volatility, you can widen spreads to protect your book.

Consider a hybrid model when:

- Your client base is diverse. Route larger clients and professional traders through A-Book while B-Booking smaller retail flow. This optimizes revenue while managing risk.

- Market conditions vary significantly. During high volatility, you might want to B-Book more trades to manage risk better. In stable markets, A-Book has more flow to capture steady commission revenue.

- You need risk management flexibility. Some instruments might work better in B-Book (like uncommon pairs with less liquidity), while major pairs can go through A-Book.

Looking Forward

Your choice between A-Book and B-Book fundamentally shapes your brokerage’s future. Consider your market, clients, capital, and risk appetite carefully. Don’t chase the model that looks most profitable on paper—choose the one that matches your operational capabilities and business strategy.

If you’re interested in optimizing your execution model over time, solutions like Brokeree Liquidity Bridge offer advanced hybrid execution capabilities. This technology lets you fine-tune your A-Book and B-Book flow dynamically so you can adapt to changing market conditions and business needs.

Book a demo