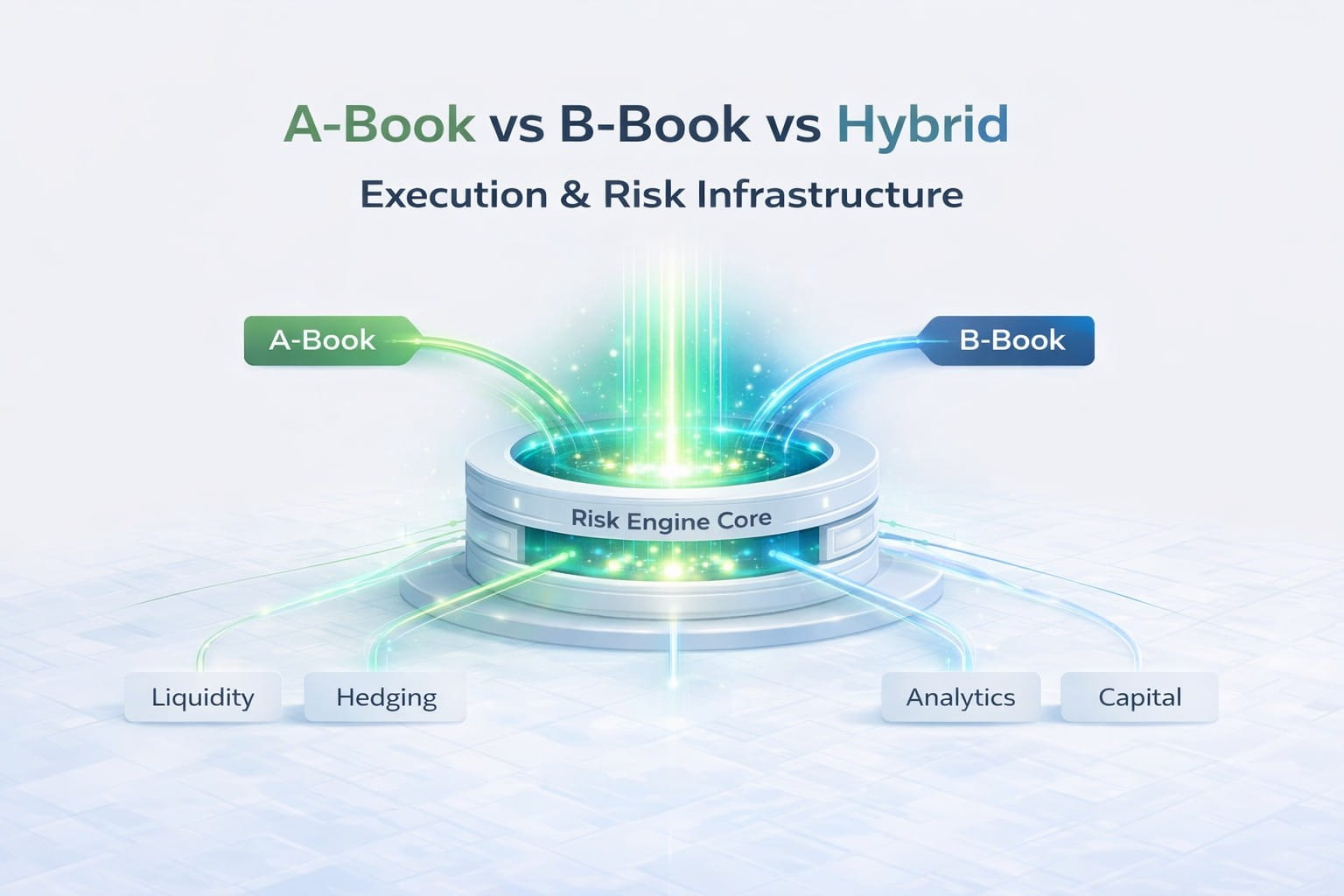

The configuration of an execution model plays a crucial role in this pursuit, and liquidity bridges emerge as the ultimate software solution for brokers looking to excel in A-Book, B-Book, and advance liquidity hybrid model.

Before diving into the benefits of brisges technology, it’s essential to understand the different execution models commonly employed in the brokerage industry.

A-Book

The A-Book execution model, also known as Straight Through Processing (STP), involves transmitting client orders directly to the market without intervention from the broker. In this model, brokers act as intermediaries, executing trades on behalf of their clients by matching orders with liquidity providers or other market participants.

Key Features:

- A-Book execution offers brokers the ability to access liquidity from multiple sources, ensuring transparent and competitive pricing.

- Brokers operating in the A-Book model do not take on the risk of clients’ trades, eliminating potential conflicts of interest.

B-Book

The B-Book execution model, also known as ECN execution, involves brokers taking on the risk of their clients’ trades by acting as the counterparty. In this model, brokers execute trades internally without sending them to the market, allowing them to manage exposure and potentially profit from client losses.

Key Features:

- Brokers in the B-Book model have greater control over their risk exposure by managing clients’ positions internally.

- Brokers can adjust spreads and pricing to optimize profitability.

Hybrid Execution

The Hybrid execution model combines elements of both A/B book solution, allowing brokers to dynamically route trades based on predefined rules and market conditions. This model provides flexibility and optimization in trade execution, leveraging the strengths of both models.

Key Features:

- Brokers utilizing Hybrid execution can route trades to the most suitable liquidity source, whether internal or external, based on predefined rules and market conditions.

- By dynamically adjusting liquidity access and pricing, brokers can optimize execution quality, minimize slippage, and achieve competitive spreads for clients.

- Hybrid execution allows brokers to apply different risk management strategies, balancing exposure between internal and external sources to mitigate risks effectively.

Brokers can choose the most appropriate execution model based on factors such as client preferences, business objectives, regulatory requirements, and risk management capabilities. Implementing the right execution model empowers brokers to offer superior trade execution, manage risks efficiently, and deliver a tailored trading experience to their clients.

Liquidity Bridge

Brokeree Solutions’ Liquidity Bridge is the turnkey software for brokers aiming to optimize trade execution across multiple models. Its advanced features and unmatched capabilities provide brokers with a competitive edge in the market.

One of Liquidity Bridge’s key advantages is its advanced order routing capabilities. Brokers gain access to a vast network of liquidity providers, allowing intelligent order routing based on predefined rules and market conditions. This ensures competitive pricing, reduced slippage, and enhanced order fulfillment. Liquidity Bridge’s advanced order routing enables brokers to optimize trade execution and provide the best possible trading conditions to clients.

This risk management feature acts as a safeguard for brokers, ensuring uninterrupted trade execution even during unforeseen technical issues. Liquidity Bridge’s ability to seamlessly switch execution to backup servers or liquidity providers helps brokers maintain stability in their trading operations and mitigate potential losses.