Liquidity bridge vs. aggregator? Explore their key differences, use cases, and how brokers choose the right execution setup as they scale.

TL;DR

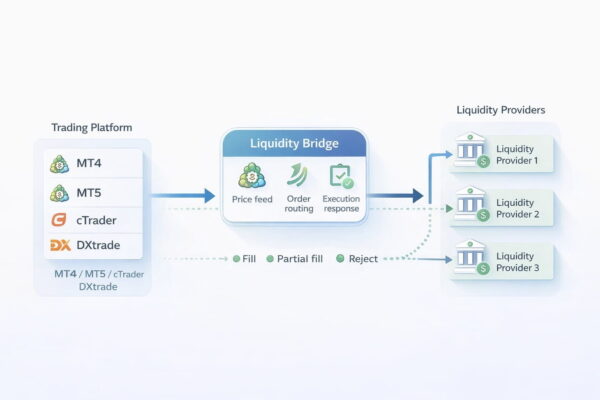

- A Liquidity Bridge is the backbone connecting your trading platform (MT4, MT5, cTrader, DXtrade) to liquidity providers. This bridge enables live execution and gives brokers full control over routing, A/B-book management, and risk mitigation.

- A Liquidity Aggregator compares prices, volumes, and availability across multiple liquidity providers. This is to ensure the best execution for every order, reducing slippage and improving pricing depth.

- Most brokers don’t choose one over the other. They use a liquidity bridge with built-in aggregation features like Brokeree’s. This setup ensures scalable, reliable execution as trading volumes grow.

- Early-stage brokers start with a bridge and 1–2 liquidity providers for a fast, stable launch. Growing or enterprise brokers need multiple LPs, smart aggregation, and advanced routing logic.

- Overall, a modern, intelligent bridge does both connectivity and aggregation. That way, they can deliver performance, risk control, and cost efficiency under live market conditions.

If you run a brokerage, you already know that execution quality is where trust is won or lost. Your traders may never see your liquidity providers, routing logic, or execution rules. But they feel the outcome every time spreads widen, orders slip, or trades freeze during volatility. Once that trust breaks, retention drops fast.

That’s why brokers tend to ask the same question at different growth stages: Do we need a liquidity bridge, a liquidity aggregator, or both? Both liquidity bridge and aggregator sound similar and are often mentioned together. But they solve different problems.

Let’s break it down in practical terms, using real brokerage scenarios. That way, you can see where each tool fits and when combining them is most effective.

What Is a Liquidity Bridge (and Why Brokers Use It)

Think of a liquidity bridge as the connection between your trading platform and the market. As the name suggests, it’s a bridge. On trading platforms like MT4, MT5, cTrader, or DXtrade, the bridge receives prices from liquidity providers, sends client orders out for execution, returns fills, rejections, or partial fills back to the platform.

Without a bridge, there is no live trading. It’s the operational backbone of your brokerage.

For example, if you run an MT5 brokerage and a trader places a EUR/USD order. The liquidity bridge receives the order from MT5, sends it to your connected liquidity provider, and returns the execution result to the trader.

Bridges start to matter strategically because of the level of execution control they give brokers. They determine how and where trades are executed, rather than leaving those decisions entirely to liquidity providers or default platform activities. They let you define routing rules, manage risk, respond to provider outages, and apply different execution logic to different client groups.

For example, with a solution like Brokeree’s Liquidity Bridge, you can decide which trades go to the market (A-book), which stay in-house (B-book), how specific client groups are routed, and what happens if a liquidity provider freezes, lags, or disconnects.

At that point, the bridge becomes your execution command center, not just a connector.

Also read: Reasons to Choose Liquidity Bridge by Brokeree Solutions

When Do You Need a Liquidity Aggregator?

As your brokerage setup grows, you typically move from one liquidity provider to several (banks, prime-of-prime firms, crypto venues, or CFD providers). This is where a liquidity aggregator comes in.

A liquidity aggregator combines quotes from multiple liquidity providers, compares prices, volumes, and availability, and selects the best execution path for each order.

Instead of asking, “Can this trade be executed?” you’re asking, “Where can this trade be executed best?”

If you’re wondering how this matters in real market situations, here’s an example.

Imagine EUR/USD shows liquidity provider A, which means a tight spread and shallow depth, and liquidity provider B means a slightly wider spread and deeper liquidity.

A smart aggregator routes based on order size, market volatility, available depth, and execution speed. This is how brokers reduce slippage during news releases, index opens, or periods of crypto volatility.

Brokeree’s Liquidity Bridge includes smart aggregation. This feature enables it to deliver dynamic order routing, Depth of Market (DoM) visibility, symbol mapping across multiple providers, and best-price execution logic under live conditions.

Related: Learn why brokers need smart liquidity aggregation.

So, in practice, it’s not about liquidity bridge vs. aggregator, but about choosing how intelligent your bridge needs to be.

Liquidity Bridge vs. Aggregator: Which Solution Is Right for Your Brokerage?

If you’re a startup or early-stage broker, your priorities are usually fast launch, stable execution, controlled risk, and simple infrastructure. At this stage, you typically need a reliable liquidity bridge, one or two solid liquidity providers, and clear execution rules.

A bridge like Brokeree’s lets you start clean, route trades correctly, and scale later without re-architecting your setup.

If you’re a growing or enterprise broker, your challenges shift. Now, you need higher volumes, more diverse client behavior, increased exposure during volatility, and greater regulatory and reporting pressure. You need multiple liquidity providers, smart aggregation and routing, depth visibility, and hybrid A-book/B-book control.

At this level, liquidity aggregation becomes essential. Most mature brokers run both, using a bridge that already includes aggregation logic. That way, execution quality doesn’t degrade as volume grows.

| Aspect | Liquidity Bridge | Liquidity Aggregator |

| Core Role | Connects trading platform to liquidity | Optimizes execution across multiple liquidity providers |

| Required for live trading | Yes | No (but highly recommended at scale) |

| Number of LPs | One or many | Multiple by design |

| Execution Models | Supports A-book, B-book, hybrid setups | Smart Order Routing — smart, dynamic, and rules-based |

| Depth of market visibility | Optional | Core feature |

| Best suited for | All brokers | Growing and enterprise brokers |

| Risk mitigation | Execution control, failover | Slippage reduction, LP redundancy |

| Key Benefit | Enables external execution and control | Ensures best pricing and deeper liquidity access |

Typical Integration Workflow (What It Looks Like in Practice)

A bridge can exist without an aggregator, but an aggregator cannot function without a bridge or another type of connectivity to execute orders. A modern setup usually follows this path:

- Connect platforms: MT4, MT5, cTrader, or DXtrade link to the Liquidity Bridge.

- Connect liquidity providers: Multiple LPs feed prices into the bridge simultaneously.

- Configure execution rules: Symbol-level routing, Client group logic, A-book, B-book, or hybrid execution.

- Enable aggregation features: Depth of Market visibility, Best-price selection, or Backup feeds and failover rules.

- Monitor and report: Execution quality, slippage, volumes, and risk exposure.

Performance, Risk, and Cost Differences Between Liquidity Bridges and Aggregators

Once a broker moves from a single LP setup to liquidity aggregation, the impact is most visible across three areas: performance, risk, and cost.

- Performance: Aggregation improves execution when markets are under pressure, not just during calm sessions.

- Risk: Multiple LPs and smart routing reduce single-point failures. If one provider lags or freezes, orders can be rerouted automatically.

- Cost: While aggregation adds infrastructure costs, it often reduces hidden execution losses from rejected orders, slippage, and trader dissatisfaction.

In practice, better execution usually pays for itself through higher retention, increased trading volume, and fewer disputes and support escalations.

Liquidity Bridge vs. Aggregator: Final Thoughts

A liquidity bridge connects you, while a liquidity aggregator makes execution more competitive.

For most brokers, the real decision isn’t choosing one over the other. It’s choosing a single solution that does both properly. That’s why tools like Brokeree’s Liquidity Bridge exist. It handles connectivity, aggregation, execution logic, risk control, and reporting in one system. You don’t get locked in rigid workflows.

If you want to see how a bridge and aggregator work together in a live brokerage environment, request a demo with Brokeree Solutions and explore how execution can be both flexible and reliable, without unnecessary complexity.

Next, read why Liquidity Bridge is the Ultimate Solution for A-Book, B-Book, and Hybrid Models.

FAQs

- Do I need both a liquidity bridge and an aggregator?

Not always. For startups, a simple bridge connecting to 1–2 liquidity providers is enough. But as your brokerage grows, using a bridge with integrated aggregation becomes essential for optimal execution and risk management.

- Can a liquidity aggregator work without a bridge?

No. Aggregators require a bridge or some connectivity layer to execute orders.

- Are there extra costs associated with aggregation?

Yes, adding aggregation may increase infrastructure costs. However, these are often offset by fewer execution losses, better client retention, and reduced disputes.

- Which brokers benefit most from using both liquidity bridge and aggregator?

Medium to large brokers with diverse clients, high trading volumes, and regulatory reporting requirements benefit most. Combining a bridge and aggregation ensures execution quality, risk mitigation, and scalability.