Forex trading platforms are fast-paced by nature, but what most traders never see is the balancing act happening behind the curtain. For brokers, every trade placed is a real-time decision: do we route this to market, absorb it in-house, or split the flow?

That’s where liquidity management for forex brokers comes in, and where things get complicated.

When Trading Volumes Surge, So Do the Risks

The global forex trading volume hit a staggering $7.5 trillion a day in 2022, according to the Bank for International Settlements. That shows brokers around the world are handling more trades, faster executions, and higher risk than ever before. It’s a high-speed, high-pressure environment where milliseconds matter.

Now, imagine a client placing a high-volume trade on EUR/USD on an NFP day. The price spikes, spreads widen, and liquidity providers scramble. If you’re a broker operating with a basic system, or worse, relying on a single LP, you’re suddenly vulnerable. Slippage, order rejections, and even server overloads become very real problems.

And if you multiply that across hundreds of clients on multiple platforms, that’s the operational pressure brokers face. The worst part is that the real damage often shows up later: angry client emails, public complaints, and even account withdrawals. A single poor execution experience during a high-impact event, such as NFP, can trigger a chain reaction, especially if the broker lacks a system for aggregating liquidity or managing exposure dynamically.

This is why proper forex broker liquidity management is super critical. And using a solution like Brokeree’s MT4/MT5 Liquidity Bridge plugin can help brokers handle these pressure points. By aggregating quotes from multiple liquidity providers, the bridge ensures the best available pricing, even when the market is volatile. This MetaTrader liquidity solution can instantly discard outdated or frozen quotes, maintaining clean pricing streams.

What Smart Brokers Do Differently

Smart brokers know that no matter how stable the market looks, volatility is just a headline away. They build around this uncertainty by using technology. They get real-time, rule-based routing control that adjusts to market shifts and trader behavior.

Brokeree’s Liquidity Bridge is designed with this flexibility at its core. Brokers can set execution conditions for different account groups, define fallback LPs, and automate how trades flow depending on symbol, time of day, or trading volume.

For example, suppose a cluster of accounts starts aggressively trading GBP/USD and Gold. In that case, the bridge can detect the volume uptick, reroute execution to the LPs with the best depth, and isolate risk exposure, without any manual intervention. Simultaneously, less active or higher-risk traders can be handled in-house, with backup synthetic feeds activated if primary sources falter.

With this structure, brokers can run a fully adaptive execution strategy that reacts faster than any manual desk ever could.

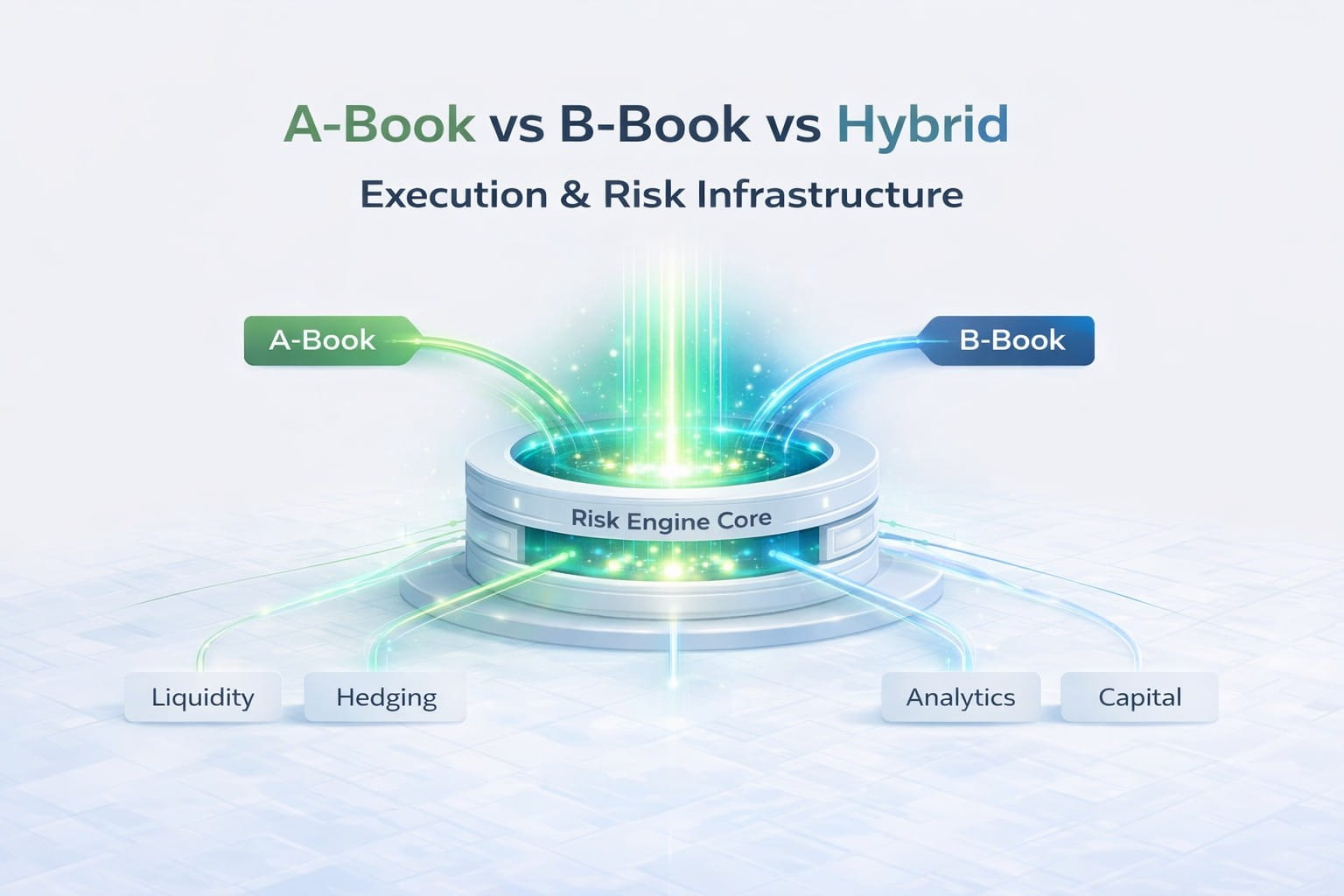

Not Just A-Book vs B-Book—It’s Both

One of the most powerful features of Brokeree’s Liquidity Bridge is its support for hybrid execution models.

Brokers define groups based on trading patterns, deposit size, and even historical performance. For example, profitable clients who trade in large volumes can be auto-routed to external LPs for market execution. At the same time, clients with erratic behavior or those trading low-volume, high-risk strategies can be kept internal.

And because the bridge sits across all MetaTrader servers (MT4 and MT5) and cTrader, it lets brokers unify this hybrid logic across their entire infrastructure. That means no duplication of rules, no execution gaps, and a much cleaner risk profile.

Brokers using the Liquidity Bridge can update routing rules in real time, analyze performance post-execution, and make changes without platform downtime. That’s how they move from rigid execution paths to fully responsive models built around performance and sustainability.

Also read: What’s the difference between a-book vs. b-book

Beyond the Bridge: What Else Can Brokers Do?

Brokeree’s Liquidity Bridge lays the groundwork for solid execution and risk control. But the brokers that truly outperform their peers use the platform as a foundation for broader operational intelligence. Here’s how:

1. Benchmark and Rotate Liquidity Providers

While Brokeree allows straightforward integration with multiple LPs, brokers can go a step further by continuously benchmarking each provider’s performance, fill speed, slippage rates, and quote consistency. This data is already accessible via the bridge’s reporting module. The smartest brokers use it to replace underperforming LPs and negotiate better terms with the top performers.

2. Create Dynamic Trader Segments

Brokeree supports client group segmentation based on fixed rules. However, proactive brokers regularly refresh those groups. By analyzing trading behavior over time—who’s scalping, who’s hedging, who’s profiting consistently—they refine routing logic. They adapt groups as client behavior evolves.

3. Time-Dependent Routing Adjustments

Liquidity shifts throughout the day. During the Asian session, spreads are tighter on certain instruments, while others become volatile during US hours. Using Brokeree’s scheduling capabilities, brokers can define routing behaviors that adjust by time block, ensuring optimal execution regardless of session.

4. Build Failover Protocols with Synthetic Feeds

Brokeree’s synthetic feed MT4/MT5 feature is more than just a backup—it’s an opportunity. Brokers can simulate custom market conditions, mirror LP feeds, or maintain trading continuity during disruptions. Setting up failover plans using synthetic feeds allows operations to continue even if a key LP goes offline.

5. Leverage Reporting for Strategic Decisions

With Brokeree’s bridge sitting between the trading platform and the market, it captures rich execution data. Brokers use this reporting not just for compliance, but also for business strategy. They track which trader groups are most profitable, which symbols face the most slippage, and when execution starts to degrade, then they act on it.

Final Thoughts

A Liquidity Bridge is not just a tool, but a framework for control. And with Brokeree, that control runs deep: across platforms, execution models, LPs, and client profiles. But it’s what brokers build on top of that control—how they adapt, fine-tune, and evolve—that truly sets them apart.

Because in today’s forex world, technology levels the playing field. But it’s strategy that wins the game.