Do multi-server solutions become outdated with the introduction of cross-server support? Brokeree Solutions answers the most popular questions about both technologies.

What is the difference between multi- and cross-server solutions?

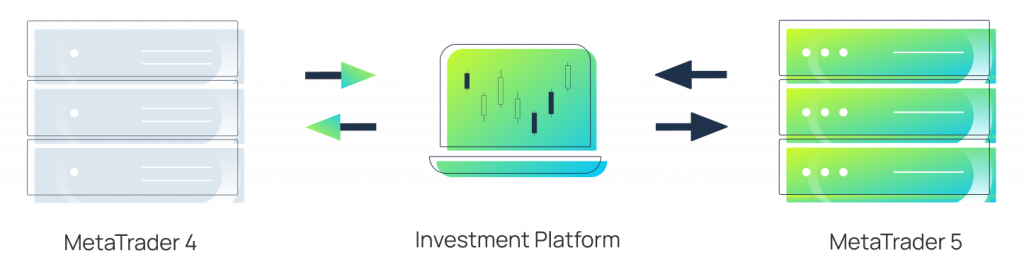

Multi-server solutions connect two or more servers of the same trading platform, providing users convenient access to data and settings of all connected entities. The key limitation of this technology is its inability to trade between different servers.

In contrast, the extended features of cross-server products allow users to perform such operations between connected servers. For example, if traders copy signals from MT4 to MT5, they use cross-server technology.

What multi- and cross-server software for brokers exists?

There are plenty of multi-server solutions designed for various purposes. For instance, as an intermediary between a trading platform and liquidity providers, a bridge collects data from several servers and provides brokers with flexible symbols settings and extended reports.

Efficient cross-server products are hardly available on the market now, because of the challenges technology providers face during its development for real-time trading. However, there are specific solutions that have cross-server features that work with aggregated funds. For example, Brokeree’s PAMM allows traders from different MT4 and MT5 to invest in each other’s accounts.

Read an expert review “The Intricacies Of Multi-Server Technology In Retail Trading”.

What challenges slow down the development of cross-server solutions?

Challenges of cross-server solutions development might be grouped into three general categories: technology, internal processes, and infrastructure.

– Technological challenges are primarily based on the differences in frameworks of trading platforms i.e., MetaTrader 4 and 5.

– Internal processes refer to potential optimization of bookkeeping and effective client support team to address clients’ requests about a new service.

– Infrastructure difficulties include additional VPS, dedicated internet line between servers, and a technical support team proficient to maintain cross-server setups.

Each of these points will be discussed in more detail below.

Which technological issues may brokers face during operation with cross-server solutions?

The technological challenges of cross-server systems mostly depend on connected servers. There are practically no difficulties establishing a connection between two MT4 servers as trade requests are processed the same way. However, when it comes to connecting MT4 to MT5, even the slightest distinction in how the data is stored or the availability of order types poses a challenge to developers. To ensure correct solution performance, the technology provider should take into account these architectural specifics.

The second technical issue is server synchronization. If there is any discrepancy in connectivity between the two servers, additional sync requests should be performed, leading to further delays. Something that may be acceptable for long-term strategies simply won’t work for high-frequency trading as a difference in prices and a time of order execution directly affect the profits.

Which internal processes may affect operation with cross-server solutions?

If all servers connected to the solution are hosted under the same regulatory authority, there is no collision in applied legal requirements. In practice, servers may be placed in different jurisdictions; for example, one server is in Australia, and another is in Germany. In this case, a broker will not only have to comply with the requirements of two regulators at once, but also find a way to correctly report performance fees transferred between the servers.

A broker should account for a potential increase in client support requests when introducing a new service. If there are any issues with a server’s performance, the team should be able to promptly respond and manage an increasing volume of user requests.

How should brokers prepare their infrastructure for cross-server solution launching?

In cases when trading servers are physically located at a considerable distance from each other, as in the example above, the time necessary to transmit the request may increase, and additional delays may appear. For instance, a brokerage provides copy trading services across several MetaTrader servers in LD4 and TY3. When a client opens a position on an LD4 server, the trade request is confirmed by a liquidity provider first. Then a copy trading solution processes the trade according to the predefined rules and forwards it to the TY3 server. Upon reaching the trading platform, the trade request has to be confirmed by an LP connected to a MT5 before the trader would see it in the client’s portal.

To minimize this effect and reduce the load on the other part of the ecosystem, the broker needs to allocate a separate server for a cross-server solution, place it equidistantly from trading servers and potentially setup a dedication internet connection.

What factors should brokers consider when launching cross-server services?

Summing up, the successful launch of a cross-server solution depends on the broker’s infrastructure and the technical effectiveness of the product. While the first factor fully depends on the broker’s activities, the second factor is the responsibility of the technology provider.

At the same time, the responsible provider may not only guarantee the efficiency of the solution but also offer to brokers maintenance services helping them mitigate risks and lift off some pressure from a brokers’ technical team. Hence, choosing the right technology provider is crucial during the implementation of such sophisticated technologies and may seriously affect the success of the whole project.

Read an expert review “The Challenges of Cross-server Technology”.

Book a technical consultation

Ask industry specialists how multi-server solutions may be implemented in your trading ecosystem during the personal consultation.